Valuing a company in its very early stages can be difficult. For the past few years, the so-called rule of 40 has become a popular way of assessing the value of software as a service (SaaS) startups and early-stage companies. Here is a closer look at how it works and when it is most useful.

What Is The Rule Of 40?

The rule of 40 is based on the concept that software companies need to achieve a balance between their growth and their profitability in order to create lasting value. The mathematics behind it is simple: Add your company’s growth rate in % to your company’s profit margin, and the result should be 40 or higher.

The calculation has been used as a health check for SaaS companies since 2015 when venture capitalists started popularizing it. The rule owes its name to investor Brad Feld, who wrote about it in his blog. Whilst the rule was generally applied to companies generating at least $50 million in revenue, Feld believed it would work as soon as a business generated $1 million.

The rule of 40 does not only work for startups but it provides a high-level health check for any software business. As a metric, it captures the trade-off businesses have to make between investing in the organization’s growth and their short-term profitability.

Launching new products and services or running a customer acquisition campaign may limit profitability temporarily. However, it will lead to growth and therefore benefit the company in the long run.

When Should Companies Use It, And When Is It Too Early?

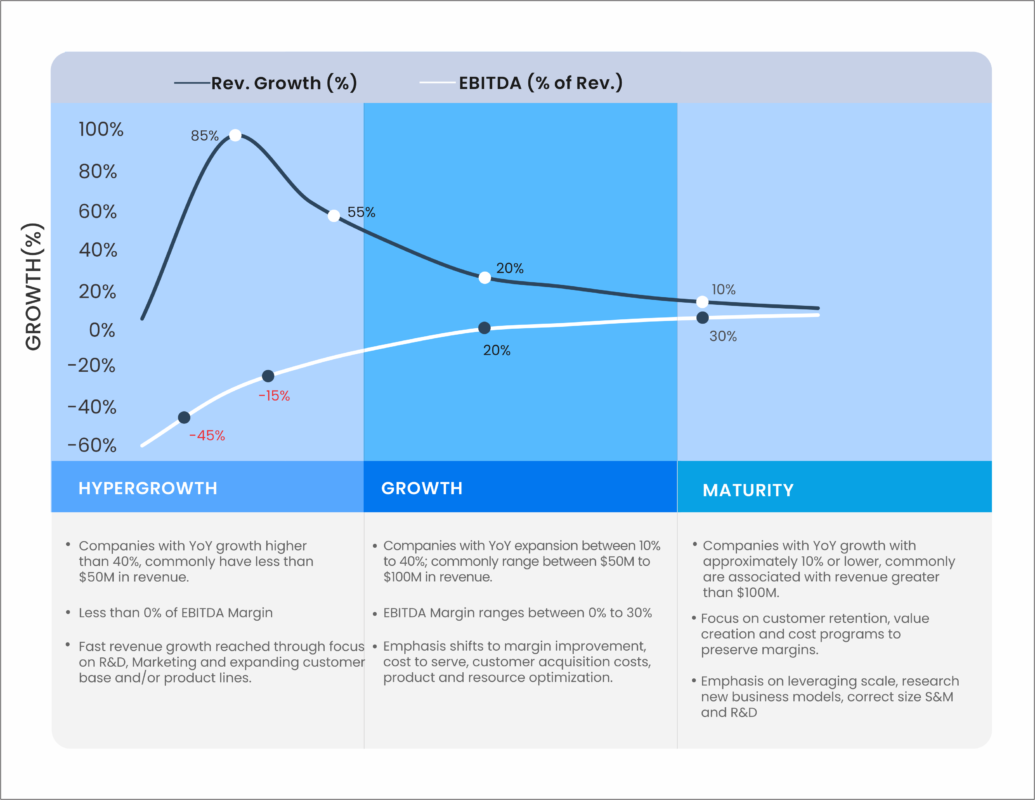

According to Bain & Company, outperforming the rule of 40 once, in a single year, is not overly difficult. This is especially the case for larger businesses and fast-growing startup companies. When measured over three or five years, respectively, it becomes harder to reach or beat the number 40.

The rule can be applied to entire businesses, but it is also useful when it comes to assessing the performance of specific business units or product groups.

Despite Brad Feld’s argument that the rule of 40 works for companies as soon as they reach $1 million in revenue, critics have pointed out that there are scenarios in which it would be too early.

This may be the case for very fast-growing, early-stage startups. Their combined growth rate and profit margin can return results that are simply unrealistic. In some cases, the calculation can yield results far exceeding 100%.

Some experts recommend waiting until a company is a few years old or until it reaches a revenue of $50 million per year. Others suggest looking at the company structure as an indicator instead. Their suggestion is to wait for an organization to have sales and marketing, customer support, and research and development departments. Another approach is to wait until a startup reaches $15 to 20 million in revenue before applying the rule of 40.

What all those suggestions have in common is the belief that the metric will yield more reliable results when the SaaS business in question has grown up a little more. Investor Dave Kellogg states that startups may be in danger of sacrificing growth and effectively hurting their valuations by focusing on the rule of 40 too early.

How To Make The Rule Of 40 Work In The Long Term

Most private equity investors believe that early-stage companies need to focus on customer acquisition to disrupt their market. This will allow them to secure access to a large portion of that market which allows for more consistent growth.

For those committed to the rule of 40, investors suggest taking a flexible approach to the split applied between growth and profit margin depending on the maturity of the company. If your organization is in the very early stages, growth needs to be prioritized with a target of 30 to 35%. In this example, the company can afford to have tight profit margins between 5 and 10%.

A more established company is unlikely to achieve these high growth rates. However, having established a more solid customer base, this mature business is in a better position to extend its profit margin. In this case, 5% growth could be supplemented by 35 or even 40% profitability, once again outperforming the rule of 40.

Is The Rule Truly Useful?

It is important to remember that the rule of 40 is only one metric for assessing the health of a startup or any SaaS business. When presenting numbers to private equity investors, founders need to ensure they explain mitigating factors or events that may have influenced the company’s performance. The rule of 40 is a useful predictor of success, but it is not the only one. SaaS startups, established companies, and other software businesses need to take a look at the business as a whole.