Empowering Middle-Market Portfolio Companies to Achieve Unmatched Value Creation

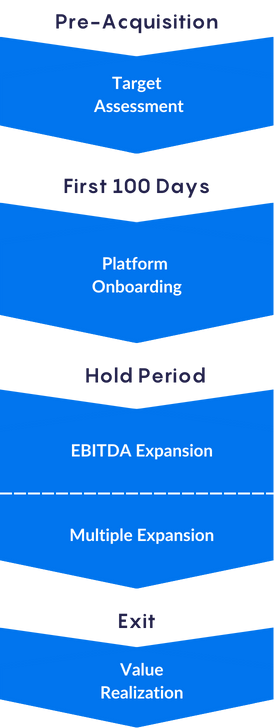

IPC adds value across the entire platform lifecycle by applying our deep expertise, tools and methodologies for the middle market companies.

At Impact Point Co. (IPC), we focus on middle market PE firms and portfolio companies. In engagements with us, you get:

We excel in acquiring top-tier talent from leading firms and immersing them in middle-market challenges and solutions. Our consultants are deeply involved in every aspect of your project.

Senior members are actively involved with your team throughout the entire engagement, providing leadership and hands-on service.

IPC will work with our Private Equity clients to customize solutions for their portfolios.

We apply proprietary tools and methodologies that ensure optimal performance and growth.

We offer several new fee schedule options for middle-market PE firms and their portfolio companies.

We focus our core competencies on FP&A and M&A operations. This specialized approach lets us accelerate value creation by enhancing FP&A functions, managing the entire M&A operations transaction life cycle, and providing strategic CFO services.

We are testing a popup

Impact Point Co. is focused on helping Private Equity firms maximize the potential of their portfolio companies. Our team has deep experience working with Operating partners and portco C-Suites to identify and deliver value creation opportunities. We Understand the PE industry and how to help our client achieve their operational performance improvement goals. This includes the following fundamental differences, when compared to large corporates: Bias towards action: We know that speed to deliver result is critical. Our core values are built around performance DRIVE as a key to success. We work directly with the PE and C-Suite to make quick decisions based on detailed analysis but focus on an expedited achievement of results. We often operate with uncertainty and do not fall into the trap of making decisions only through consensus. Understanding of your investment horizon : We understand the bigger picture; PE firms are looking to create short-term value and that each portfolio company has an exit timeline , We consider the investment horizon as part of everything we do to help the portco achieve rapid success. Prioritization based on maximizing value : We help portfolio companies with prioritizing initiatives and opportunities based on what will make a meaningful impact. We understand that rapidly growing EBITDA thorough growth opportunities and through cost efficiency opportunities is the main objective, and we have both the team and operational know - how to help maximize your potential. Spotlight on private Equity

Chad Stacey Partner Chad Stacey is one of the founding partners of Impact Point Co., and leads the firm’s M&A Services group. Based out of New York, Chad has 16+ years of experience in providing professional services to clients from the PE middle market through to Fortune 100 companies. His experience includes merger integration planning & execution, synergy assessments, carve-out support, cost efficiency and working capital optimization. Chad tailors Impact Point’s M&A services methodologies to each client, and his expertise spans many industries including technology, telco, industrials, healthcare, consumer products, and pharmaceuticals. Chad also serves as the Program Director for the US M&A Executives Council for The Conference Board, a not-for-profit think tank composed of M&A leaders from the world’s largest acquirers. Prior to founding Impact Point, Chad previously worked within Alvarez and Marsal’s Private Equity Performance Improvement group, primarily focused on supporting PE Portcos in the middle market to execute their portfolio investment strategies. Chad led programs including merger integration, carve-outs, cost take-out and other performance improvement initiatives. Prior to A&M, he worked with EY in London, UK and Perth, Australia, where he delivered transaction advisory services, due diligence and working capital optimization for both Private Equity portcos and public companies. His qualifications include a BCom from Curtin University in Western Australia, and his postgraduate qualifications include a GradDip in Applied Finance from the Financial Services Institute of Australasia (FINSIA), and he is a qualified CA (Institute of Chartered Accountants, Australia and New Zealand).