Benefits of Add-on Integration Assessment

- Reduce Distractions: Management can focus on the business and reduce distractions for customers and operations.

- IMO Tools to Support Efforts: Gain access to IMO tools, frameworks, and processes.

- Protect Your Investments

- Faster Integration: Integrate quicker so there are fewer longtail integration issues to manage in future years.

- Knowledge Transfer: Management learns to run the integration of future acquisitions with less support.

How IPC Works with Your Teams

Within a few weeks, IPC can leverage its experience with handling hundreds of integrations and deliver an initial assessment with the following key objectives/deliverables.

- Identify the status/level of integration of add-ons to the platform for fundamental areas.

- Provide main levers/quick hits to execute to integrate the chief focus areas further.

- Deliver/document future-state operating model for the platform to support more value creation.

- Deliver roadmap/plan to achieve full integration.

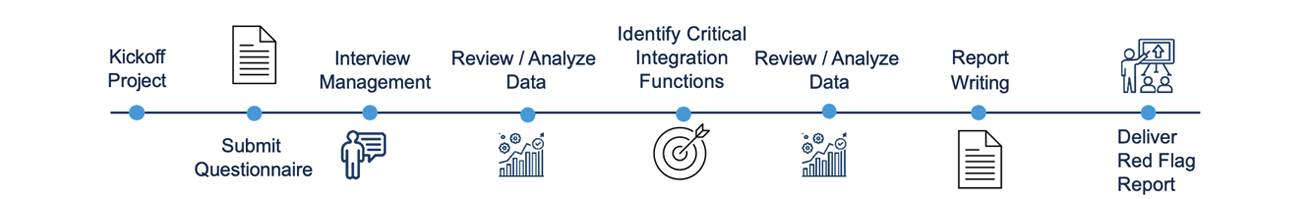

Integration Assessment Framework

- Meet with Management to share project scope and approach.

- Understand the background and history of add-on, including strategic rationale and investment thesis.

- Submit integration questionnaire for management to complete and data requests (past integration checklists, documentation, synergy anaylysis, value-creation plans, etc).

- Prepare and share management interview agenda; schedule meetings.

- Review available data and the questionnaire and develop an initial assessment.

- Perform integration assessment interviews for add-on.

- Assess critical and non-critical areas for integration.

- Understand add-on and related integration nuances.

- Update DRL and resubmit as needed.

- Develop initial red-flag report outline.

- Continue to research, analyze, and assess integrations.

- Draft and finalize deliverables report.

- Update DRL and resubmit as needed.

- Submit deliverables report to client.

- Hold client readout session.

- Update and finalize deliverables report.